When it comes to managing your finances, understanding the implications of interest rates on your monthly payments is crucial. Many individuals and families find themselves navigating the complex world of loans, mortgages, and financing options. One of the most common queries is centered around what the monthly payment would look like in the context of a specific interest rate. In this article, we will dive deep into the mechanics of loans, specifically focusing on a scenario where the interest rate is set at 5% and the monthly principal and interest (P&I) payment amounts to $3,780.

Whether you are considering purchasing a home, refinancing your existing mortgage, or taking out a personal loan, understanding how interest rates affect your payments is essential. This article will explore various aspects of payments, interest rates, and loan terms to provide clarity on what a monthly payment of $3,780 at a 5% interest rate means for borrowers. We will also address common questions that arise within this realm, ensuring you have the knowledge needed to make informed financial decisions.

By the end of this article, you will have a better understanding of how the interest rate impacts your payment structure, as well as the total cost of borrowing over time. Let's embark on this financial exploration together!

What Does a Monthly P&I Payment of $3,780 Represent?

A monthly P&I payment of $3,780 is the amount you would pay each month toward the principal and interest of a loan. But what exactly does this payment encompass? Let's break it down into simpler terms.

Principal and Interest: What Are They?

When you take out a loan, it is important to understand the two main components of your monthly payment:

- Principal: This is the original amount of money you borrowed.

- Interest: This is the cost of borrowing the money, expressed as a percentage of the principal.

How is the Total Payment Calculated?

Calculating your total payment can be complex, considering various factors such as loan term, total loan amount, and the interest rate. Let's explore how these elements come together.

What Formula is Used to Calculate Monthly Payments?

The formula used to calculate monthly payments on a fixed-rate loan is:

M = P[r(1 + r)^n] / [(1 + r)^n – 1]

Where:

- M: Total monthly payment

- P: Loan amount (principal)

- r: Monthly interest rate (annual rate divided by 12)

- n: Number of payments (loan term in months)

What is the Impact of a 5% Interest Rate on My Loan?

The interest rate you secure for your loan significantly impacts your overall payment. A 5% interest rate is relatively common, but how does it affect your payments in our example?

How Much Would You Pay Over Time?

If your monthly P&I payment is $3,780 at a 5% interest rate, it is important to understand how this translates into total payments over the life of the loan. Let's analyze a hypothetical loan amount to illustrate this.

What is the Loan Amount Based on a $3,780 Payment?

To find out the potential loan amount that corresponds to a monthly payment of $3,780 at 5%, we can rearrange the payment formula.

How to Estimate the Loan Amount?

Using the formula provided earlier, one can estimate the loan amount. For instance, if you want to find out the maximum loan amount you can get for a fixed monthly payment:

P = M / [r(1 + r)^n] / [(1 + r)^n – 1]

By substituting in your known values, you can determine the loan amount associated with your monthly payment of $3,780.

What are the Total Costs Over the Life of the Loan?

Another consideration when analyzing your payments is the total cost of the loan over its lifespan. With a consistent payment of $3,780, how much will you pay in total?

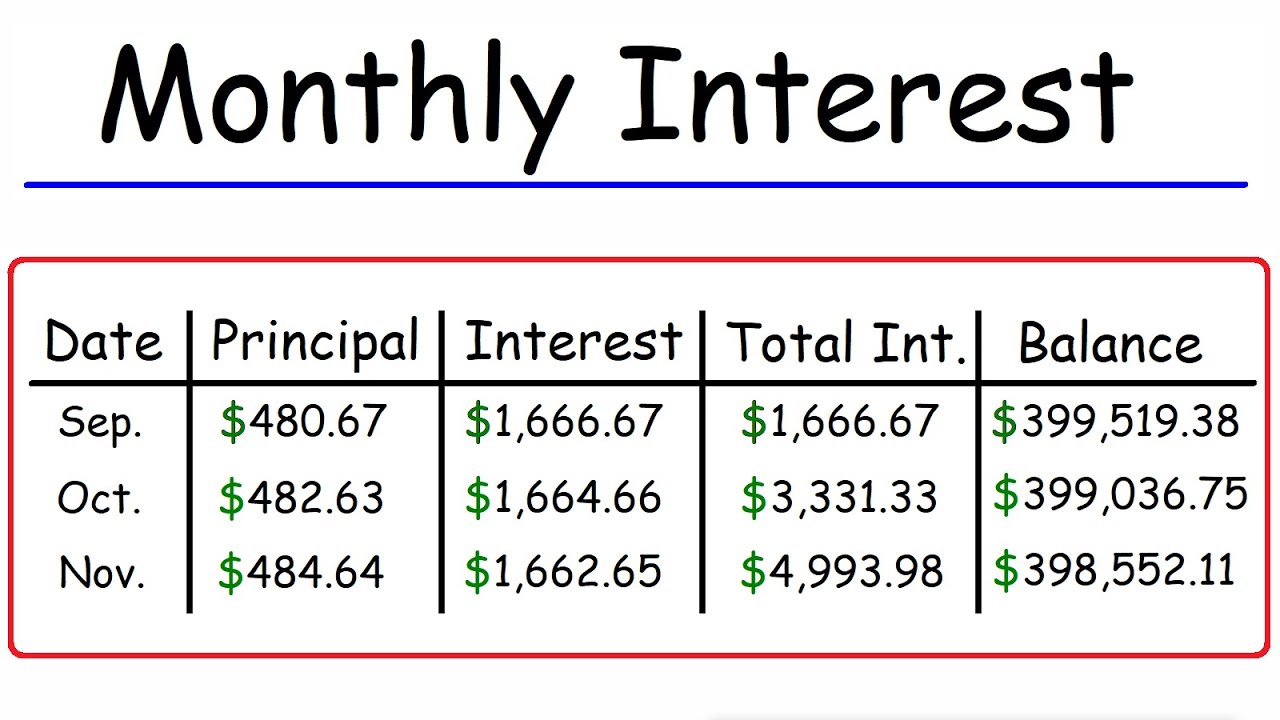

Understanding Total Interest Paid

To determine the total interest paid, you can multiply your monthly payment by the total number of payments and subtract the original loan amount:

Total Interest = (M * n) - P

This formula will give you an idea of the total cost of borrowing, highlighting how much interest accumulates over time.

How Can You Prepare for a Loan with a 5% Interest Rate?

Preparation is vital when considering any loan. If you are planning to take out a loan with a monthly P&I payment of $3,780 at a 5% interest rate, there are steps you should take.

What Should You Consider Before Applying?

- Credit Score: Ensure your credit score is in good standing to secure the best interest rates.

- Loan Term: Decide on a loan term that fits your financial situation.

- Budgeting: Make sure the monthly payment fits comfortably within your budget.

Conclusion: What Have We Learned About Payments at 5% Interest?

In summary, understanding the dynamics of a payment if the interest rate is 5% with a monthly P&I payment of $3,780 is crucial for anyone considering a loan. From breaking down the components of your payment to calculating the total costs over time, knowledge is power. As you embark on your financial journey, remember to stay informed and be prepared for the commitments that come with borrowing.